ELMO 2021 HR Report – Recruitment

Recruitment is one of the key responsibilities of the HR department. It is a critical organisational activity that involves multiple stakeholders and directly impacts business success. However, the recruitment process is costly and typically lengthy, consisting of several stages: e.g. defining the role, advertising the role, generating a talent pool, screening candidate resumes and conducting interviews. With so much riding on the recruitment process, employers must do what they can to maximise efforts.

So, how do organisations in Australia and New Zealand approach recruitment and what are their main challenges? To find out, ELMO partnered with the Australian HR Institute (AHRI) to survey more than 1800 HR professionals – and the results revealed some interesting insights.

First, some top-line recruitment statistics:

- On average, it takes 33.4 days to fill a vacant position. Australian organisations typically fill vacant roles within an average of 33 days. The time taken to fill roles is slightly longer in New Zealand, at an average of 36.5 days.

- The average cost to hire a new employee is $10,500 and is over twice as much for C-level executives.

Changing priorities

Given the events of 2020, it was not surprising to see a shift in HR priorities. Indeed, there was a significant reduction in the priority given to recruitment in 2020 compared to 2019, since fewer organisations intended to grow their workforce. In 2019, three-quarters of respondents (75%) said recruitment was a high or medium priority for their organisation, in comparison to only two thirds of respondents (66%) in 2020. It can be presumed that COVID-19 and the decline in hiring sentiment was a predominant factor in this priority shift.

Recruitment challenges

Nevertheless, hiring wasn’t off the table entirely, and it seems many of the same challenges remain stubbornly in place. The most common recruitment challenges facing organisations included: competition for talent (according to 47% of respondents); skills shortages (42%); and building a stronger employer brand (31%). However, there was a steep decline in all areas since 2019 – again, since recruitment was less of a priority in 2020: less recruitment means less challenges.

This development may also be attributed to the advancement in and adoption of recruitment technology. In 2020, two-thirds of respondents had fully implemented technology, compared to only half of the respondents in 2019. It appears this momentum will continue. When respondents were asked about the projected implementation of recruitment technology in 2021, 86% said such technology would be ‘fully implemented’ by the end of the year.

To see the responses broken down by industry type, business size, geography, and job seniority, download the report here.

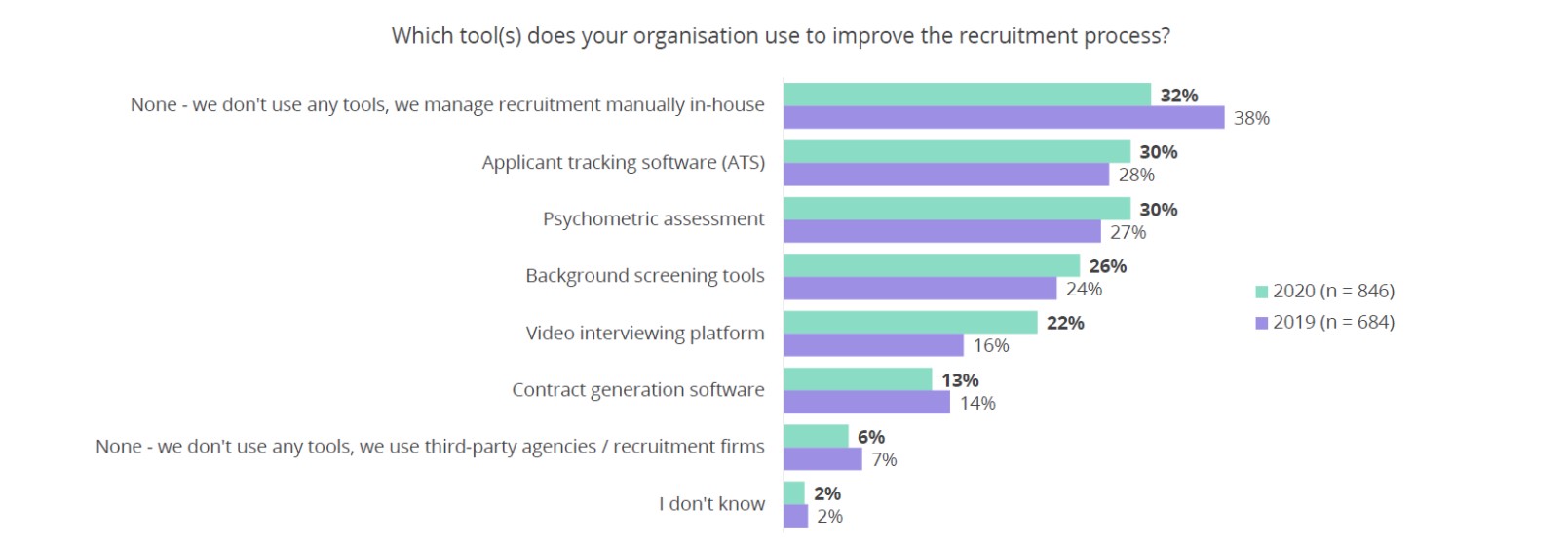

Recruitment tools

When asked which tools were used to improve the recruitment process, the responses produced two noteworthy findings: Firstly, the most common response was ‘None – we don’t use any tools, we manage recruitment manually in-house’ (32%). This response was most prevalent among SMBs (38%) and less common for enterprise-sized organisations (7%). Mid-market responses sat in the middle at 26%.

Enterprise and mid-market respondents favoured applicant tracking systems (ATS) to improve the recruitment process (54% and 43% respectively), whereas just 19% of SMBs use ATS. The rise in adoption of ATS – and the fact that there was a decrease in the percentage of organisations managing recruitment activities manually in-house (from 38% to 32%) – suggests a growing trend towards the automation of recruitment tasks.

The second noteworthy finding that this question presented is that the percentage of organisations using video interviewing platforms increased from 16% in 2019 to 22% in 2020. This is unsurprising, considering COVID-19 caused businesses to move many processes online to abide by social distancing measures.

Looking ahead

Regardless of whether hiring was frozen, continued with few changes, or escalated in 2020, employers have been dealing with a new, uncharted business environment. In 2021, time should be taken to align workforce planning strategies with the broader business plans. As these business plans will constantly be course-correcting to deal with the aftershocks of COVID-19, any workforce strategies must also be adaptable.

This blog only presents top-level results from one section of the ELMO 2020 HR Industry Benchmark Report. If you’d like a comprehensive overview of HR and payroll trends, challenges, use of metrics and technology, download your report today. The HR Industry Benchmark Report provides in-depth insights into the current state of end-to-end HR processes, including recruitment and onboarding, learning & development, performance management, and more. Data in our report is split by company size, geography (Australia / New Zealand), role seniority, and industry^ – enabling you to benchmark your current HR practices against your peers.

^Report+ only.

HR Core

HR Core