The Future of Payroll: Preparing for a Transformed Workforce

The familiar landscape of payroll, with its paper trails and time-consuming calculations, is rapidly fading into the past. New tech and a changing workforce are making payroll faster, more automatic, and more data-focused. But what does this mean for businesses, and how can they prepare for this evolving landscape?

Let’s explore how AI and automation are impacting various aspects of payroll, from data entry to compliance. We’ll also discuss how today’s diverse and tech-savvy workforce is shaping the future of payroll. This will guide you through the changes and help you build a successful business for the new era.

What are the key changes in payroll systems that occurred in 2023?

The landscape of payroll underwent a dramatic shift in 2023. A period of significant transformation, driven by technological advancements and a changing workplace landscape. Here’s a glimpse of how payroll systems have evolved in 2023:

Gone are the days of manual data entry and tedious calculations because payroll is embracing automation. Smart machines like AI are taking over boring payroll tasks, like checking timesheets and figuring out taxes. This gives HR and Finance pros more time to focus on important things. This not only improves accuracy and efficiency but also reduces the risk of errors.

The growing number of cyber-attacks made data security a top concern. Payroll systems implemented robust security measures to protect sensitive employee information. Multi-factor authentication, and access control measures became essential features, protecting sensitive employee information from cyber threats.

Simplify tax compliance with the payroll solution. Keeping up with ever-changing regulations is a nightmare, but the payroll systems make it easy. Modern payroll systems do the calculations and filing for you, keeping you on the legal track.

Payroll systems give priority to employee self-service empowering employee experience. Employees could see their payslips, update their addresses, and choose their health insurance plans through secure online portals. This made it easier for them to stay informed and manage their finances.

What are the impacts of remote work and the gig economy on payroll management?

The traditional 9-to-5 office model is steadily fading, replaced by a more fluid and dispersed workforce. Remote work and gigs are growing, making payroll harder but also opening doors for improvement.

Remote work

Working from home introduces complexities like managing different time zones, tax regulations, and labour laws across various locations. Tracking work hours accurately and ensuring compliance with local regulations becomes more intricate. Additionally, payroll systems need to adapt to accommodate diverse payment structures for both traditional employees and independent contractors.

- Payroll system operations: The payroll system operations of a business change significantly with remote work. Remote workers can be tricky for payroll, processing their pay, whether part-time or full-time, can get complex depending on where they live.

- Tax implications: Tax laws vary from state to state as well as for various countries around the world. Payroll admins need to understand how different laws affect each employee’s pay, from taxes to work hours.

- Geographic pay differentials: Paying everyone the same when living costs vary wildly is a challenge.

Gig economy

Classifying workers as employees or contractors requires careful consideration to avoid legal effects. Payroll systems need to handle non-standard work arrangements, fluctuating pay schedules, and varying tax implications. Paying gig workers on time and taking out the right amount for payroll taxes and benefits is key to keeping them happy.

- Dynamic payment schedules: In the gig economy, payment schedules are often contingent on project milestones or specific results.

- Tax withholding and reporting: As self-employed, gig workers need to estimate and pay their taxes to the government.

- Tracking work hours and productivity: The constant churn of independent contractors is making payroll a challenge for companies.

What are the trends in payroll systems and technology for 2024?

1. AI and automation

Artificial intelligence and machine learning will further penetrate payroll processes, automating repetitive tasks like data entry, compliance checks, and even forecasting future requirements. This frees up valuable time for HR professionals to focus on strategic initiatives.

2. Integrated payroll

Imagine your payroll, HR, time tracking, and finances all talking to each other. This connected system would make managing your employees easier, faster, and more insightful.

3. Real-time analytics

Advanced analytics capabilities will unlock real-time insights into workforce trends, labour costs, and employee engagement. This empowers businesses to proactively manage their workforce and improve decision-making.

4. Financial wellness

Payroll systems are teaming up with financial wellness programs, giving you access to money-saving tips, budgeting tools, and even custom advice, all right there with your paycheck. This means you can feel more confident about your finances and happier at work.

5. Cybersecurity

With the increasing sophistication of cyber threats, robust data security measures will be crucial. Secure cloud-based payroll software, encrypted data storage, and multi-factor authentication will become essential safeguards for sensitive payroll information.

6. Mobile-first experience

Imagine accessing your paystub, choosing your benefits, or even tracking your hours – all with a few taps on your phone. Mobile apps put the power of payroll in your pocket, making it easier and more convenient for employees and HR alike.

7. Global expansion

Global companies can now handle employee pay easily across different countries thanks to new payroll systems that are flexible and can grow with them. These systems make it simple to follow different tax rules in each country.

8. Biometrics and blockchain

New techs like fingerprint scans and secure data networks promise to make payroll safer and easier to understand in the future.

Embrace future-proof payroll solutions and stay informed about the latest payroll trends. This will help you navigate the changing world of work with ease, delivering a seamless, efficient, and secure payroll experience that keeps your employees happy and productive.

How can businesses future-proof payroll by embracing technological advancements?

The pace of technological innovation is relentless, and the payroll platform is no exception. Businesses need to be quick to adopt new technology to stay on top and get the most out of it. Here are some key steps to future-proof your payroll:

1. Assess your current system

Start by taking stock of your existing payroll technology. Is it cloud-based and scalable? Does it offer the flexibility and integrations needed for future advancements? Conducting a thorough evaluation will highlight potential gaps and guide your upgrade decisions.

2. Upskill your team

Training your HR and payroll team on new technology keeps things efficient and compliant. Understanding AI, automation, and data analytics will be crucial for navigating the future of payroll.

3. Embrace continuous learning

Stay ahead of the curve by establishing a culture of continuous learning within your business. Encourage teams to stay informed about emerging technologies and their potential impact on payroll. Attending industry conferences and workshops can be a valuable resource.

4. Partner with experts

Consider partnering with payroll service providers who possess expertise in the latest technologies and evolving regulations. Their guidance can ensure smooth implementation and ongoing support as your payroll system adapts to the future.

5. Focus on data security

With increasing focus on data privacy, focus on robust security measures to protect sensitive employee information. Regularly assess your system’s risks and implement necessary upgrades to safeguard against cyber threats.

6. Foster a collaborative approach

Break down silos between departments and ensure effective communication between HR, payroll, IT, and finance teams. Collaboration is key to successfully integrating new technologies and increasing their benefits.

By taking these proactive steps, businesses can position themselves for success in the face of technological advancements. Keeping your payroll system up-to-date isn’t a one-shot deal, it’s like a journey where you embrace change, learn new things, and adapt to what’s coming. Stay compliant and stress-free with paying employees with a future-proof payroll solution.

A future-proof payroll for your dynamic workforce

The world of work is evolving rapidly, driven by technology, remote work, and a dynamic talent pool. CEOs can no longer afford outdated payroll systems that struggle to keep pace. The question isn’t if, but when, their current solution will become a roadblock to agility and efficiency.

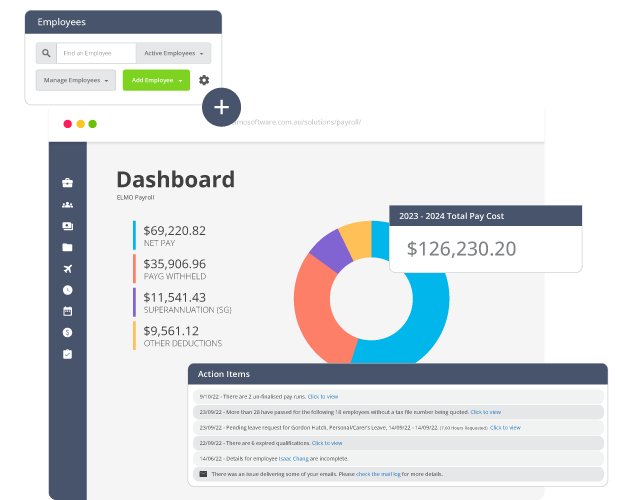

So, what lies ahead? A future powered by innovative payroll software like Elmo Software. Imagine a system that seamlessly adapts to your changing workforce, automates time-consuming tasks, and unlocks valuable data insights. A system that fosters a positive employee experience and simplifies compliance, freeing you to focus on strategic growth.

This is the future Elmo Software offers. Here’s a glimpse of what you can expect:

- Cloud-based agility: Access your payroll data anytime, anywhere, with our secure and scalable cloud platform. Adapt and grow without limitations.

- Data-driven insights: See what’s working and what’s not with instant reports that show you everything from employee happiness to hidden savings.

- Seamless integration: Connect your payroll data with other HR and business systems for a unified view of your workforce.

- Employee self-service: Empower your employees with self-service portals to manage their payroll information, reducing administrative burden and boosting satisfaction.

Don’t just update your payroll system, get ready for the future of work with a future-proof approach. Together, we’ll craft a payroll system that fits your unique goals and aspirations.

Future-proof your payroll with expert guidance. Get a free consultation now!

HR Core

HR Core