Retirement in the modern age: how to create a culture of retirement readiness

Retirement has changed significantly over recent decades; navigating the future of work now requires an acute awareness of the evolving business landscape and a willingness to redefine approaches.

Until recently, “retirement” was a pretty rigid concept: people would cease working around the age of 60 years and then enjoy 10 to 15 “golden years” living off their pension or superannuation savings. However, over the past few decades the expectations around retirement have altered and the parameters around workplace demographics have become more complex. The trajectory from working life to retirement is less resembling a straight “career” ladder, but rather a zigzagging pinball.

So, what does this mean for businesses and what can they do to make the most of mature age workers? Let’s look at the factors to be considered.

Ageing workforce

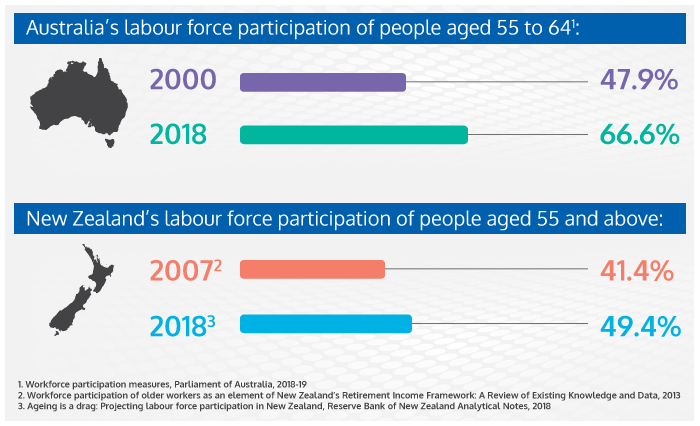

Every generation of retirees experiences a different set of challenges to the generation before them. Today, Australians and New Zealanders are living longer, retiring later and saving less.

As nations, both Australia and New Zealand have two of the longest life expectancies in the world (82.5 years and 81.4 years respectively). Both sit above the 2017 OECD average of 80.6 years[1].

Longer life expectancies mean that mature workers are now more likely to remain in employment for longer. Baby boomers make up a large proportion of the workforces of Australia and New Zealand – see below.

Flexible working

Another factor encouraging mature workers to remain in employment is that there is greater availability for flexible and less physically demanding forms of employment which, paired with the fact there is no “official” retirement age in Australia or in New Zealand, is allowing older workers to write their own retirement journey.

Financial pressures

Financial considerations are also contributing to the shift in retirement patterns. For one, the growth rate of superannuation balances is slower[2], and the age at which people are eligible for the Age Pension is rising – in Australia it is currently 65½ but will increase to 67 by 2023, which is higher than New Zealand whereby the pension pay-out age has remained 65.

Although these financial factors are, in part, due to the impact of the global financial crisis, there are also government incentives keeping mature workers in employment[3]. In November 2019, Australian Treasurer Josh Frydenberg called the ageing population – and the anticipated mass exodus of baby boomers from the workforce – an “economic time bomb” and urged older people to work for longer.

Retirement trends today

Mature age workers are more likely to enter other forms of employment instead of retiring completely. According to The Household, Income and Labour Dynamics in Australia (HILDA) survey[4], one in four Australians between the ages of 45 and 59 return to employment each year. This means that the overall transition from full-time work to retirement is less rigid and spans a longer period.

So, what does all this mean for employers? They must ensure their business fosters retirement readiness and makes plans for the future.

It is very likely that your mature workers will become brand ambassadors or consultants for your business, so helping them along their retirement journey will not only benefit them, but it will benefit you.

Creative approaches to retirement will enable your business to strategise, prepare and guide today’s generation of mature workers towards retirement. Under-preparation in terms of retirement has negative repercussions for both older workers and employers. A “best employer” approach is outline below:

Workforce development

- Embrace flexible work options – e.g. part-time, remote, job sharing, etc.

- Offer a retirement plan that offers employee health, wellness, financial benefits and education to help lessen the stress and uncertainty of retirement. More than half (56%) of surveyed organisations do not have a transition-to-retirement strategy in place.[5]

- Rethink the traditional career ladder and job paths by offering job rotation opportunities or even “reverse” mentoring whereby junior workers share insights with seniors, rather than the other (traditional) way around.

- Many mature age workers relish professional development, yet one study8 indicates that only 54% of employers offer continued access to training and development to employees in their late careers – so don’t forget about them when creating learning pathways and plans.

Future proofing

- Develop valuable workers and offer opportunities for knowledge transfer, including coaching/mentoring, and formal documentation of tasks and processes to improve business sustainability. This is critical: when people walk out the door, so too does their knowledge – so capture it while you can.

- Implement succession plans to gain insights into future workforce gaps, reduce flight risks, identify future consultants/contractors, and accelerate employee skill development to reduce business risk associated with loss of key talent.

- Aim to reduce conscious and unconscious bias in the workplace. The most common recruitment practices for attracting older workers are reported as offering flexible work arrangements (42%), and training recruitment staff to ensure practices are free of age bias (32%).8

Does your business have a succession plan in place? If not, ELMO’s Succession Management solution is designed to help business leaders and HR professionals develop and manage talent pipelines effectively, helping to boost both employee and business productivity. Succession management is a key tool for helping older workers to transition into retirement whilst forecasting skill shortages and seamlessly filling gaps.

The face of retirement is changing, and businesses need to adapt accordingly. After all, retirement is inevitable and the better a business can serve retirement and recognise the importance of fostering future preparedness, the more effective and productive both employee and employer will be.

ELMO Cloud HR & Payroll’s end-to-end solutions streamline the entire employee lifecycle, from hire to retire. ELMO addresses all key employee-employer touchpoints, including recruitment, onboarding, performance management, payroll, rostering / time & attendance, learning & development, and more, allowing leaders to better manage workers and continually develop strategic solutions to enhance business performance. To find out more, contact us.

[1] International health data comparisons, 2018, Australian Institute of Health and Welfare

[2] Super Insights 2019, KPMG

[3] Access all ages: older workers and commonwealth laws, Australian Law Reform Commission (ALRC), 2013

[4] The Household, Income and Labour Dynamics in Australia Survey, Melbourne Institute, 2017

[5] “Employing Older Workers”, research report by the Australian Human Resources Institute, 2018

HR Core

HR Core