Pay rises might be on the cards, but …

“Majority of voters say record low wages growth is an election issue”; “Wages growth a pressing issue”; “Wage inflation still missing in action” …

A glance at the headlines of the past 12 months makes for depressing reading – at least for employees hoping for a salary increase.

Wage growth in Australia has stagnated at 2.3%, which one economic survey suggests is where it’ll remain throughout 2019, instead of climbing to 2.75% on its way to 3% by mid-2020, as forecast in the last budget update[1]. This gloomy outlook comes despite wage growth hitting the highest level in 3 years in the September 2018 quarter, which admittedly was helped by a large 3.5% increase in Australia’s minimum wage rate at the start of the quarter, along with updated enterprise agreements.[2]

In New Zealand the story is slightly more encouraging. The Half Year Economic and Fiscal Update 2018, released in December 2018 by the New Zealand Treasury[3], indicated hourly wages rose 3.0% in 2018, and are forecast to rise 3.1% in 2019, 3.3% in 2020 and 3.5% in 2021.

Another view

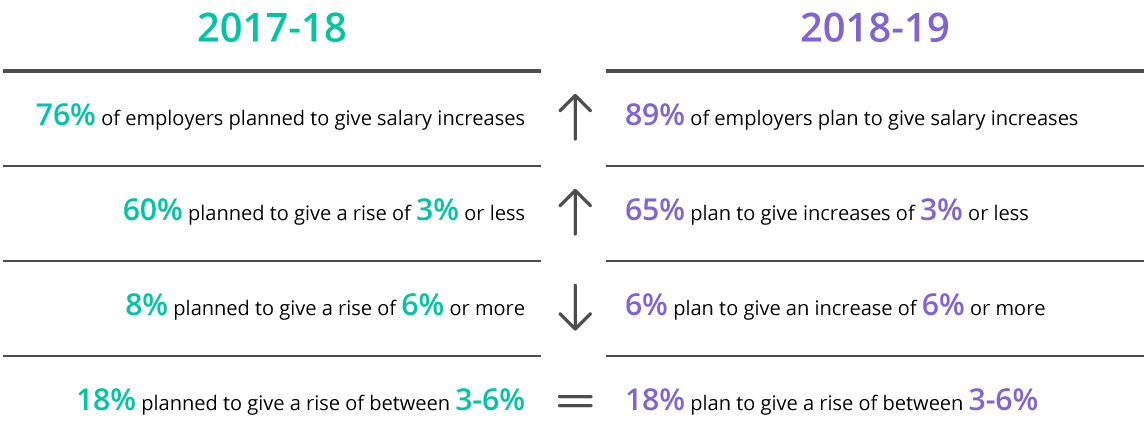

Not everyone agrees with the pessimistic outlook. Among the insights gleaned from the Hays 2018-19 Salary Guide, which surveyed 3,000 business leaders in Australia and New Zealand, is the fact that during this financial year, more employers will be offering salary increases – however, these increases will be smaller than last year. Here’s how the last 2 years compare:

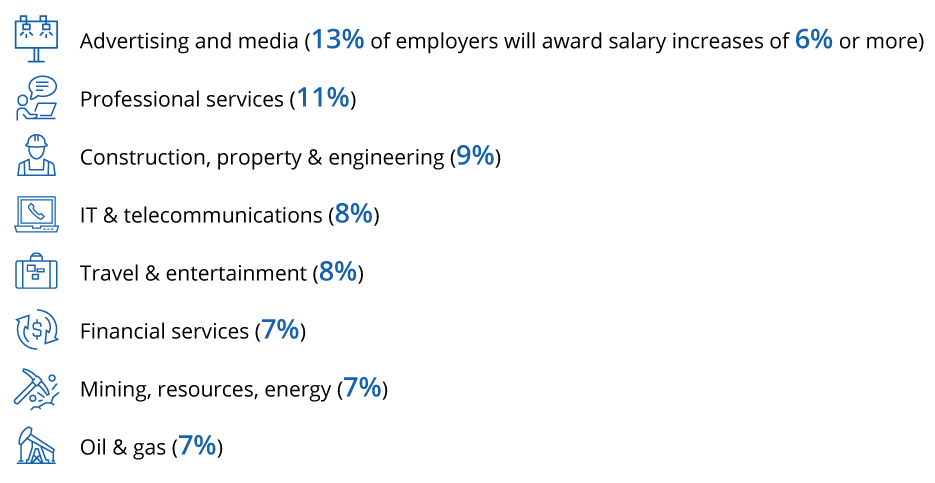

Who’s getting an increase? The most generous industries are:

What employees want

Hays also surveyed over 1,200 professionals for their views on salary, and based on their responses, the proposed (minor) increases may not be enough. As a group they have higher expectations for a salary increase than the 2017-18 survey, with 17% (up from 14% last year) expecting an increase of 6% or more.

When asked what was most important to their career in 2018-19, 67% said a pay rise – perhaps no surprise given the sedate wage growth of recent years.

So, what can employers do if they cannot meet these salary expectations? Here are 3 approaches to consider – which might convince the 46% of surveyed employees who are currently looking for a new job to stay where they are.

- Rethink the Total Remuneration Package

The term Total Remuneration Package, or TRP, has gained popularity in recent years. A simple TRP might consist of base salary plus bonuses, incentives, and higher superannuation contributions. A TRP can also include non-financial benefits such as company cars, car allowances, salary sacrificing, mobile phones, laptops, gym memberships, extra annual leave, etc.

A better option might be a Total Value Package, sometimes referred to as a Total Rewards Strategy. This even more holistic view of the employee/employer relationship poses a key question to candidates or employees: What is the total amount of value you can get from working in this role, at this organisation, at this stage of your life/career?

For some, this might mean having the flexibility to work from home – both to tend to family/carer commitments or to simply avoid a lengthy commute. Irrespective of the base pay on offer, the thought of commuting 4 hours each day is likely to take the shine off. For other employees, this might mean cross-skilling, upskilling or reskilling to ensure they remain employable. This might even involve an industry switch. Again, workplace flexibility to allow for study, coupled with learning opportunities offered by an employer, can benefit both parties.

Mercer, a consultancy known for its advocacy of Total Rewards, says the success of such a program comes from HR data analytics – and moving from “I think” to “I know” in terms of what goes into the Total Rewards mix. Mercer suggests: “The new emphasis must be on data-driven correlations, forecasting, predictive and causal modelling that tells precisely what’s working – and what will work – for business success, and which rewards will ensure an employee population that delivers sustainable growth.”[4]

- Forget about career ladders

Where career progression once meant a step-by-step climb up the corporate ladder, today this is no longer the case. A static, straight-up career trajectory doesn’t work as effectively for a new generation of workers; it doesn’t offer varied work or the chance to try new things and it doesn’t help them to keep their options open.

It’s telling that many believe the career ladder still lies at the heart of career development and succession management – that’s how engrained it is in the collective corporate memory. However, the idea that you work for a stretch in one position, then move upwards to a slightly flashier title with greater remuneration and just a few more responsibilities added to the existing pile just doesn’t cut it.

Today, employers should consider offering something more like a scrambling net, or career lattice, where people can move up and down, but also side to side. Along the way, employees work in different teams and different departments, working on projects and broadening their skills base. Related to this is a new perception of “leadership”, with employees able to take the lead on projects no matter what their title is – something that would be extremely rare with the traditional career ladder.

- Offer bespoke benefits

Personalisation has become a buzz term over the past 2 years. While the concentration has been on personalising learning, onboarding and performance management, it’s now spreading to other areas within HR’s remit, including benefits. To create a bespoke benefits suite, it’s critical to know whether your offerings are in-tune with what employees want.

According to the 2018 Hays Salary Guide, the most common benefits offered by employers are flexible work practices (84%), ongoing learning & development (73%), and career progression opportunities (66%). Fortunately, these are in sync with the top 3 benefits that people most want when looking for a new job.

It’s important to remember that one-size-fits-all does not work with benefits, so even if those are the 3 most sought-after benefits, it’s not to say everyone wants them, or will use them in the same way. Workforces are more diverse, multi-generational, multi-ethnic and geographically dispersed than ever before. Ideally, benefits should be tailored to match the different wants and needs of employees. Profiling exactly who makes up a workforce and offering a more bespoke set of perks or benefits is one way to get cut-through.

Just one disclaimer about benefits: flexibility is increasingly becoming standard, making its absence a recruiting (and retention) limitation. If your organisation does not offer flexible working options, Hays suggests you’re in the minority and “this could have an obvious impact on attraction and retention”. Hays recommends reviewing and implementing basic policies in this area, such as staggered start and finish times.

Money talks

The old saying “money doesn’t talk, it yells” will always apply and the lure of more remuneration when the cost of living is so high will be tough to counteract. However, by refining your employee value proposition and emphasising all the great things your company can offer – from carer paths to a commitment to continuous learning – you may just convince those with itchy feet to stick around.

ELMO Remuneration aims to take the pain out of your salary review process. ELMO Remuneration is designed for organisations with straight-forward or complex remuneration requirements and provides better visibility of the entire process by identifying bottlenecks and providing clarity around remuneration decisions against budgets. For further information, contact us.

[1] https://www.abc.net.au/news/2019-01-29/economic-survey-points-to-bleaker-times-post-election/10755350

[2] https://www.businessinsider.com.au/australia-wage-price-index-q3-rba-cash-rate-inflation-gdp-outlook-2018-11

[3] https://treasury.govt.nz/sites/default/files/2018-12/hyefu18.pdf

[4] “What to Expect from the Next Decade of Total Rewards”, Workspan Magazine, 2016

HR Core

HR Core